Portfolio Management of Multi-Asset Strategies

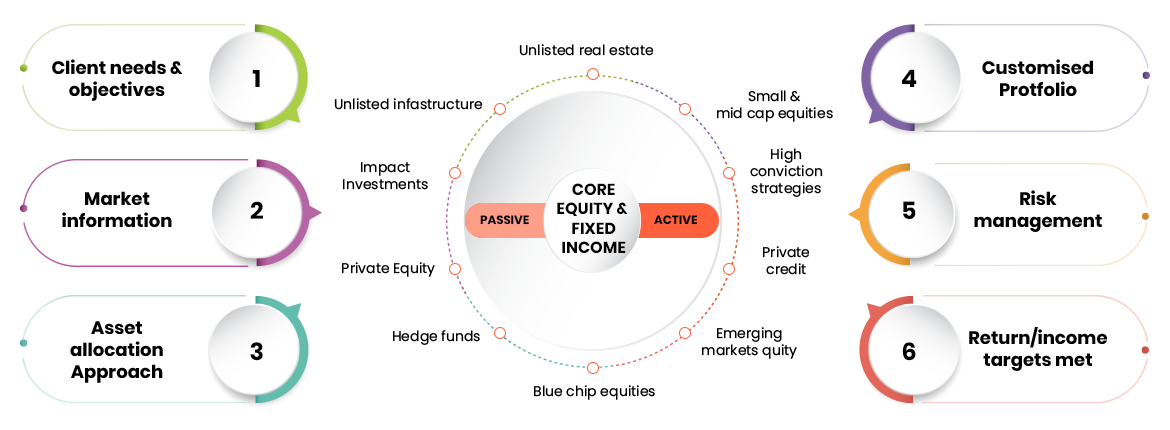

Core-Satellite Portfolio Management Approach

Core Component

Stability and Long-Term Growth: The core is typically a larger portion of the portfolio, consisting of investments intended for stability and long-term growth. These investments are often more conservative, such as index funds, broad market exchange-traded funds (ETFs), or other passive investment vehicles that track major market indices. The core aims to provide a solid foundation for the portfolio by capturing market returns with low costs and lower volatility.

Diversification: By mirroring the broader market or specific segments, the core component helps achieve diversification, reducing the risk associated with individual securities

Satellite Component

Active Allocations for Higher Returns: The satellite portions of the portfolio are smaller, more tactical allocations designed to achieve higher returns. These can include active investments in specific equities, sectors, themes, regions, or alternative investments like commodities, real estate, PE, or hedge funds.

Flexibility and Adaptation Satellites allow our clients to take advantage of research driven tactical opportunities in trends or to gain exposure to higher-risk areas that have the potential for higher returns. This part of the portfolio is more actively managed and can be adjusted based on market conditions or changes in investment goals.

Benefits of the Core-Satellite Approach

Risk Management: By maintaining a substantial core of stable, diversified investments, the overall risk of the portfolio is managed more effectively.

Cost Efficiency: The use of low-cost index funds or ETFs in the core helps keep the overall expenses of the portfolio down, as these typically have lower management fees compared to actively managed funds.

Performance Potential: The satellite investments offer the potential to outperform the market, contributing to enhanced portfolio returns while the core provides steady growth.

Flexibility: This approach offers flexibility to adjust the satellite components in response to changing market dynamics or investment opportunities without altering the core philosophy of the portfolio.

Core-Satellite