Insights & Commentary

Market Update - June Quarter 2024

Welcome to the June Quarter Letter

WRAP-UP OF EQUITY MARKETS

Since the quarter ending on 30 June marks the end of the financial year 2024, we will also recap returns for the fiscal year as well as the past quarter.

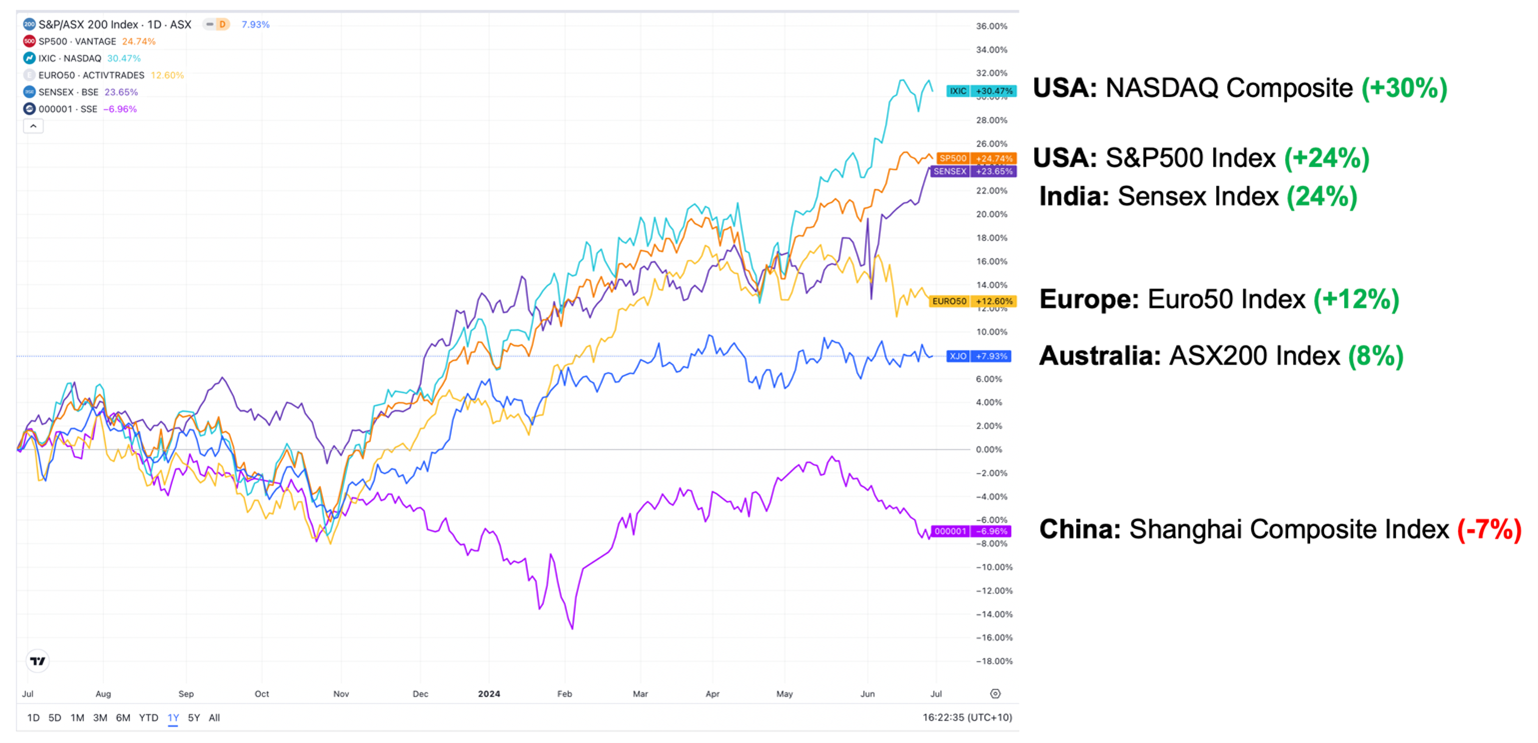

Figure 1: Financial Year Ending June 2024 – Major Equities Market Performance

Figure 1: Financial Year Ending June 2024 – Major Equities Market Performance

The past year has been a good one for global share markets, with investment returns generally in the high double-digit percentages.

US STOCKS PERFORMANCE ANALYSED

International shares have been the highest performers in our clients' multi-asset portfolios over the past year. Given that US stocks represent 60-80% of the diversified ETFs and active funds we use in our portfolios, it is worth taking a closer look at the sources of returns in US stocks during Fiscal Year 2024.

In Figure 1 above, you can see that the technology-heavy Nasdaq Index tops the ranking list with a +30% return, followed by the broader US market-focused S&P 500 index, which rose by 24%.

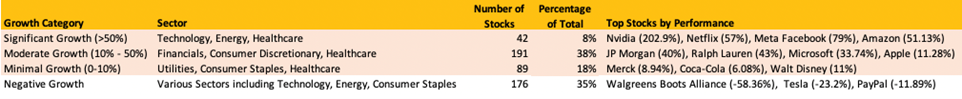

Delving deeper into the sources of these returns, as shown in Figure 2 below, approximately 8% (or 42 stocks) of the S&P 500 index delivered returns greater than +50%. This group includes stocks like Nvidia, which grew by +203% over the past 12 months, making the +50% growth in Amazon’s share price seem relatively underwhelming.

A significant portion of US-listed stocks, 38% (or 191 stocks) of the S&P 500, experienced share price growth between 10%-50%, spanning consumer-facing industries such as healthcare and financials.

However, it is also key to note that more than a third of the US stock market posted negative returns over the past year. Specifically, more than 100 stocks in the index saw returns of less than -10%, which is quite significant.

Figure 2: S&P500 Distribution of investment returns in FY2024

Figure 2: S&P500 Distribution of investment returns in FY2024

What this tells us is that the distribution of returns in the US equity market varied widely over the past year, from double-digit positive returns to double-digit negative returns. To generate excess returns, or even overall positive returns in global shares, portfolio construction had to focus on the positive side of the return distribution due to the high possibility of exposure to many underperformers in the index.

During individual portfolio reviews, our clients would have noted our discussions about solid double-digit returns in their multi-asset strategies, with the majority of excess returns driven by international shares, primarily US and technology stocks.

We hope that the above returns distribution analysis demonstrates that skill, experience, and analysis were applied to strategically position your portfolios towards the more profitable segments of international shares and to avoid the underperformers.

Over a year ago, investors needed to understand and position their portfolios to capitalize on technology stocks potentially driving excess returns.

In our quarterly letters, we have consistently identified technology as a clear driver of investment returns over the medium to long term. Accordingly, we have positioned our clients' portfolios towards this theme through funds like the Munro Global Growth Fund (+31%), Magellan Global Fund LIC (+42%), NASDAQ ETF (+26%), and QUAL ETF (+28%).

To reiterate, the major growth themes that we have positioned our clients’ portfolio to are:

- Technology

- Shift to Renewables (commodities)

- Healthcare due to ageing demographic

- China/US cold war causing reshoring of supply chains

- India’s ongoing rise

WHAT ELSE HAS WORKED WELL FOR US IN EQUITIES?

We have also maintained our conviction in the Indian market (up +24%) and minimized exposure to China (-7%). As you can see from the returns noted in Figure 1 above, this was a decision based on a correct reading of geopolitics and macroeconomics, contrary to general market consensus. We invested with conviction, and the GQG Emerging Markets Fund, our key exposure to India and other emerging markets, delivered a +35% return last year, confirming our analysis. /p>

Separately, in our March quarterly letter, we highlighted European stocks as becoming interesting and clearly undervalued. We discussed positioning clients in the UK's FTSE 100 index, which we specifically pointed out as undervalued. For those clients whose risk profiles allowed it, we took a position in the FTSE 100 ETF since March, and this position has enjoyed a running positive return of approximately 8%.

WHAT ELSE HAS WORKED WELL FOR US IN EQUITIES?

Our clients know that we follow a strict discipline of harvesting profits and redeploying them in other undervalued opportunities. Over the past year, investment grade credit and, to a limited extent, Australian hybrids are where we have been placing our excess returns generated particularly from international stocks. Our major calls in credit over the past year have generated the following returns:

- Perpetual Diversified Income Fund has generated a total return of 8.6%. We noted to clients at the time of positioning in portfolios that we expected this fund to generate at least 6%.

- VanEck Australian Subordinated Debt ETF has generated +7.5%; we expected +6%.

- VanEck Australian Floating Rate ETF generated 5.7%; we expected +5%.

- The various hybrids, including those that were newly issued over the past year, have generated approximately an 8% return for clients. We keep our hybrids allocation in portfolios at about 10%.

Our clients also know that we have been keeping their asset allocation defensively positioned toward growth, i.e., approximately 5-10% tactically under their strategic asset allocation to growth, given our cautious view of the equity markets. The overweight is in credit, entirely in shorter-duration and floating interest rate credit securities. We will lend longer at fixed rates in portfolios when we gain more comfort with inflation settling down and some reduction of obvious risks to growth, e.g., high interest rates weighing on economic activity, China slowdown, US presidential election, war risks in the South China Sea/Taiwan, and supply chain disruptions.

WHAT IS THE OUTLOOK?

We have a bifocal outlook for the equity markets: the next six months, and then 2025 and beyond, which can also be termed the post-modern economic cycle with some unique characteristics.

In the short term, we believe the Australian and US economies are walking a tightrope, maintaining high interest rates to slow down economic activity and risking a recession. Yet, inflation remains persistent due to excess government stimulus from tax cuts, cost-of-living relief measures, and strong government spending on infrastructure. Due to high interest rates and slowing consumption, several Australian companies have begun to report earnings downgrades and a negative outlook for the next six months.

For this reason, we have taken an underweight position in growth for client portfolios, and for the first time in a few years, we are introducing government bonds into portfolios through the Pimco Global Bond Fund. The rationale behind using this bond fund is that if the share market retreats due to recession risks, this could increase unemployment and slow inflation in the short term. In such a scenario, we would expect government bond prices to rally, driven by their higher attractive yields.

WHAT IS THE OUTLOOK?

We live in the postmodern world, where everything is possible and almost nothing is certain. – Vaclev Havel, FMR President of Czech RepublicKnowing the key features of the future economic environment will help us position our clients' portfolios accordingly. The period from 1982 to 2020 is described as the Modern Economic Cycle, characterized by its unusual length, low macro-economic and political volatility, and declining interest rates. Despite various crises, financial markets generally recovered well, bolstered by policy interventions such as interest rate cuts. This environment conditioned investors to anticipate policy support from central banks during economic downturns or external shocks, underwriting positive investment returns as interest rates continued to fall.

The advent of quantitative easing (also known as money printing by central banks to finance government spending on economic recoveries) post-financial crisis further propelled equity markets from 2009 to 2020, though the benefits were not uniformly distributed. High-growth companies, or those with long-term growth potential, thrived in a zero interest rate environment, while mature industries often lagged due to excess supply.

The narrative changed post-2020 with the end of pandemic restrictions and a return to rising interest rates in response to new inflationary pressures, marking the beginning of what is termed the Post-Modern Economic Cycle. This new cycle demands a shift in economic discipline and asset valuation.

While investors often focus on short-term market changes, understanding the broader structural shifts from the Modern to the Post-Modern Cycle is crucial for navigating future risks and opportunities. The shifts, as we see them, are as follows:

- Return of Donald Trump to the Oval Office: Based on Joe Biden's poor performance in the first presidential debate against Trump last week, and questions regarding his fitness to lead for another five years, Trump’s chances of returning to the Oval Office seem to be increasing by the day. If Trump returns to power, we can expect an acceleration of de-globalization, higher tariffs to protect US industry, and a potential trade war against the world, not just China. He has even suggested that tariffs could replace income taxes, promises lower taxes, doubts the validity of climate change, and claims he could resolve the Ukraine-Russia war as president-elect, even before formally taking office.

- Increasing Cost of Capital: As we transition from quantitative easing to tightening, interest rates and inflation, which have been low since the early 1980s, are rising. This shift is expected to lead to higher yields, both nominal and real. Aging demographics will also shift the savings pool from accumulation to draw-downs, reducing the supply of capital and raising interest rates.

- Slowing Growth Trends: The rate of population growth is slowing, potentially reducing long-term economic growth rates. However, advancements in artificial intelligence could enhance productivity and offset some of these effects.

- Shift from Globalization to Regionalization: After decades of increasing globalization driven by technological advancements and geopolitical events, there is a shift towards regionalization. This shift is facilitated by technological advancements that make local production more cost-effective and less labor-intensive. Additionally, geopolitical tensions and protectionist policies are fostering environments that favor regional trade and production.

- Rising Labour and Commodity Costs: The post-pandemic landscape is marked by tighter labor and commodity markets, reversing the trend of the last two decades where energy and labor were abundant and cheap.

- Increased Government Spending and Debt: Contrasting with the period of deregulation and smaller government size starting from the 1980s, the current cycle is characterized by more regulation, larger government, higher taxes, rising corporate interest expenses, and potentially lower corporate profit margins.

- Increased Capital and Infrastructure Investment: While investment in traditional capital like plant and machinery has declined relative to sales since the early 2000s, there is an anticipated increase in capital expenditure. This is driven by needs to simplify supply chains for security and environmental reasons, along with heightened spending on defense and decarbonization initiatives.

- Changing Demographics: Many developed economies are experiencing aging populations, leading to higher dependency ratios and increased financial burdens on governments. This demographic shift is expected to drive higher government borrowing and taxes.

- Rising Geopolitical Tensions and a Multipolar World: The previously unipolar world led by the US post-Soviet Union era after 1991 is shifting towards a multipolar world order with rising Chinese influence, likely increasing global uncertainty and risk, which could elevate the returns required by investors to invest in stocks and bonds (risk premia and the cost of capital).

The above characteristics of a changing economic and political landscape globally should make for actively positioning portfolios to take advantage of the emerging opportunities as much as avoiding the emerging risks, much like the sorts of risks and opportunities we successfully navigated over the past 12 months.