Insights & Commentary

September Quarter Letter - "Happy days are here again" Really?

Welcome to our market update for September Quarter 2024.

REVIEW OF SHARE MARKET RETURNS - ABNORMAL RETURNS UNSUSTAINABLE

It has been a great year so far for major global share markets, with indices in Australia and the US nearing record highs. The performance of these two markets is particularly important for Australian investors, as they represent the majority of equity exposures in portfolios. European and, to a lesser extent, Asian markets hold small portfolio allocations, serving mainly to enhance returns. This year, our exposures to India and the UK's FTSE 100 stocks have certainly contributed positively.

Referring to Figure 1 below, the Australian share market has delivered +18% (excluding dividends) on a 12-month rolling return basis, while US shares have generated returns in the range of 35%-37% over the same period. While we are pleased with these stellar returns, it must be emphasised that these are not typical!

Figure 1: Performance (%) of Australian ASX200 Index, US S&P500 Index, NASDAQ Composite Index (Technology shares)

Source: Market Index, Sovereign Advisors, returns as at 04 October 2024

Source: Market Index, Sovereign Advisors, returns as at 04 October 2024

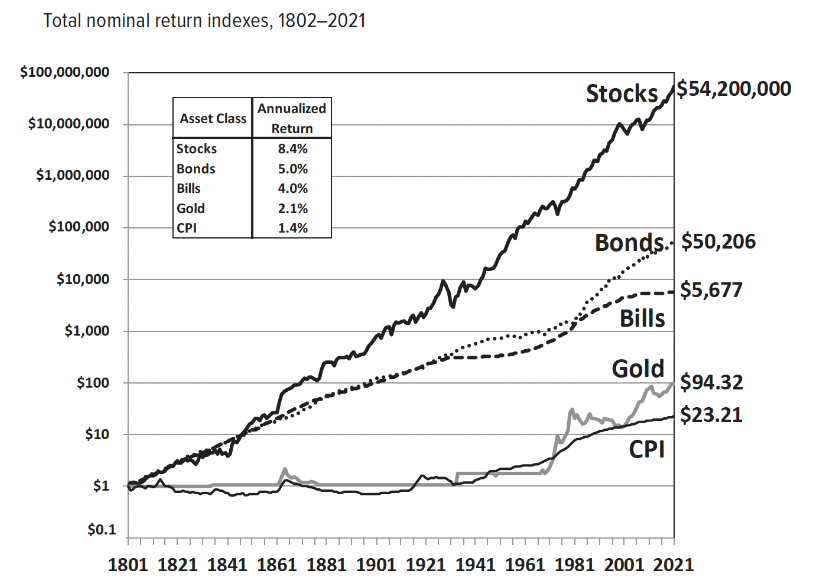

On a long-term timeframe (refer to Figure 2 below), equity markets are expected to deliver returns in the range of 8-12% p.a. Therefore, it is unrealistic to assume that markets will continue generating the high double-digit returns seen this year. For the principle of long-term average equity returns to hold, equity markets will likely need to take a breather and either move sideways or correct at some point in the future.

Figure 2: US Share market long term returns

Source: Stocks for the Long Run - The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies - McGraw Hill (2022)

Source: Stocks for the Long Run - The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies - McGraw Hill (2022)

To further emphasise this point, the US S&P500 share market index (refer to the IVV ETF) has delivered 15% p.a. over both the past 5 and 10 years in Australian dollar terms (USD returns are similar). This is largely due to the strong double-digit growth of US shares over the past year, which has inflated medium- to long-term returns beyond the sustainable long-term average that equity markets are typically prepared to deliver to investors.

Similarly, for Australian shares (as measured by the performance of the VAS ETF), although the returns are more modest at 8.25% p.a. over five years and nearly 9% p.a. over ten years as of 04 October 2024, they are still within the range of long-term average returns. As discussed later in this piece, the Australian share market faces headwinds and lacks catalysts for growth in the near term, so Australian shares have their work cut out for them to ensure they remain within the long-term average range of 8-12% p.a.

We will continue to take profits in the equities asset class and selectively recycle profits from high-growth companies to companies with more mature, stable business models and balanced earnings growth outlooks. Importantly, we intend to keep benefiting from the excellent returns available in credit securities, where we have been averaging approximately 7% p.a. across our exposures.

Our market update offers in insight into some of the major issues responsible for shaping our cautious view of equities in the short term.

US FEDERAL ELECTION RESULT MAY IMPACT MARKETS IN 2025

Given our view that share markets are well-priced, the US market needs a strong positive catalyst to give it another hurrah post-election. We believe Trump, if elected, will likely provide the US share market with a greater short-term catalyst than Kamala Harris. Interestingly, during Trump's previous presidency between January 2017 and January 2021, the US share market rallied by +80%, or approximately 16% per annum.

Kamala Harris’s re-election, on balance, poses downside risks to the US equity markets, as her policies appear largely a continuation of Joe Biden’s—i.e., more of the same economic policies, aiming for a soft economic landing and promising to reduce costs in the economy and for households. In fairness, this has already been achieved, with inflation now back in the normal range, so voters are unlikely to be excited by this policy at the polls.

Kamala Harris, on the one hand, wants to be liberal in trade with China and the world, but also recognises that an increasingly politically assertive China is a problem that will not go away and will likely worsen over time, requiring a response. Indeed, Biden’s adoption of Trump’s first round of tariffs against China at the handover of the presidency in January 2021 gives Trump higher marks for being proactive on political risks. The US middle and labour classes are also weary of the Democrats, who began outsourcing manufacturing jobs to China during the Clinton years by embracing China into the WTO trade network, which has since resulted in stagnant middle-class wages and the hollowing out of the US’s industrial capability—something it now seeks to rebuild in earnest.

Kamala Harris has also backtracked from being deterministic and decisive on the transition to renewable energy by removing the ban on producing gas through fracking. Her campaign has also backed away from Joe Biden’s New Green Deal, which included a $1 trillion investment in green technologies that would have ended the US economy’s reliance on fossil fuels within 10 years. Harris is swaying toward more Trumpist nationalist economic policies but with less impact and appears reactionary.

Trump, on the other hand, is being quite forthright with his economic policies, stating that he will pursue deregulation, cut taxes, and reduce government spending, which is in direct contrast to Harris, who plans to raise spending and taxes. Trump also aims to boost fossil fuel-based energy and drive down inflation as a result. He intends to make the US an energy superpower, which will lower energy costs for households and support the rapid reindustrialisation of the US as a low-cost manufacturer.

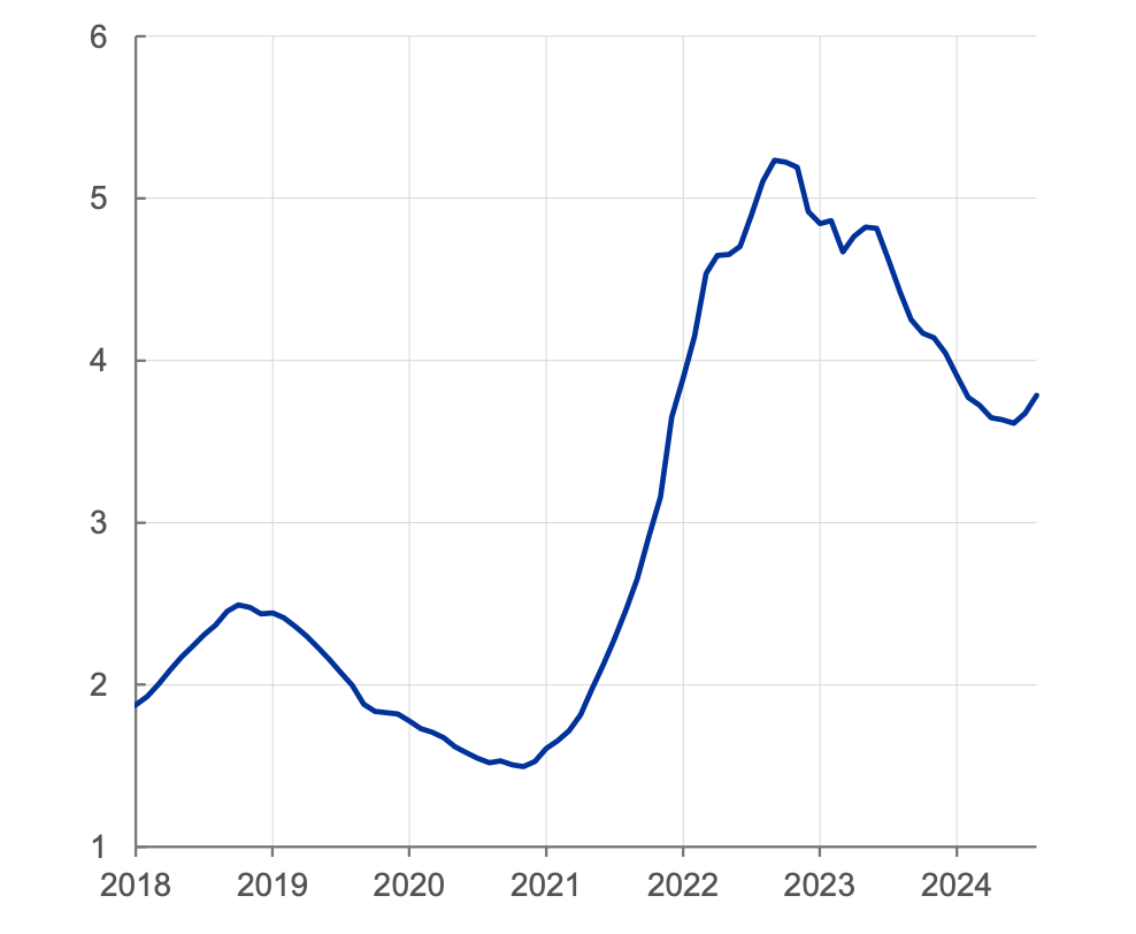

The US’s cost advantage in cheap energy (refer to Figure 3 below, which consolidates costs across gas, electricity, coal, and oil) has already leapfrogged ahead of Europe, where energy costs are almost four times higher. This has Germany and other European manufacturers worried, as they risk losing business to US industry while European businesses are forced to shut down facilities, a process that is already beginning.

Figure 3: Energy prices in the Euro area relative to the United States (ratio, 12-month moving average)

Sources: Trade data monitor, IMF, ADB-MRIO and ECB staff calculations, August 2024

Sources: Trade data monitor, IMF, ADB-MRIO and ECB staff calculations, August 2024

Additionally, while Harris has been polling higher in recent months, a wildcard that could work in Trump’s favour in the weeks leading up to the election could be the escalating war in the Middle East involving Israel, Iran, Lebanon, Palestine, and the Houthis in Yemen. Biden and Harris have proven powerless at brokering a ceasefire or ending the war, which has now been raging for 12 months with no end in sight. The prospects of an all-out conflagration are becoming real.

It is quite possible that a significant portion of traditionally far-left Democrat voters will abstain from voting in the next presidential election in protest against the war, which could help Trump gain numbers, as the conservative vote is likely to remain sticky on this issue.

INFLATION AND INTEREST RATES ARE NORMALISING - RELIEF FOR HOUSEHOLDS AND BUSINESSES WILL TAKE TIME

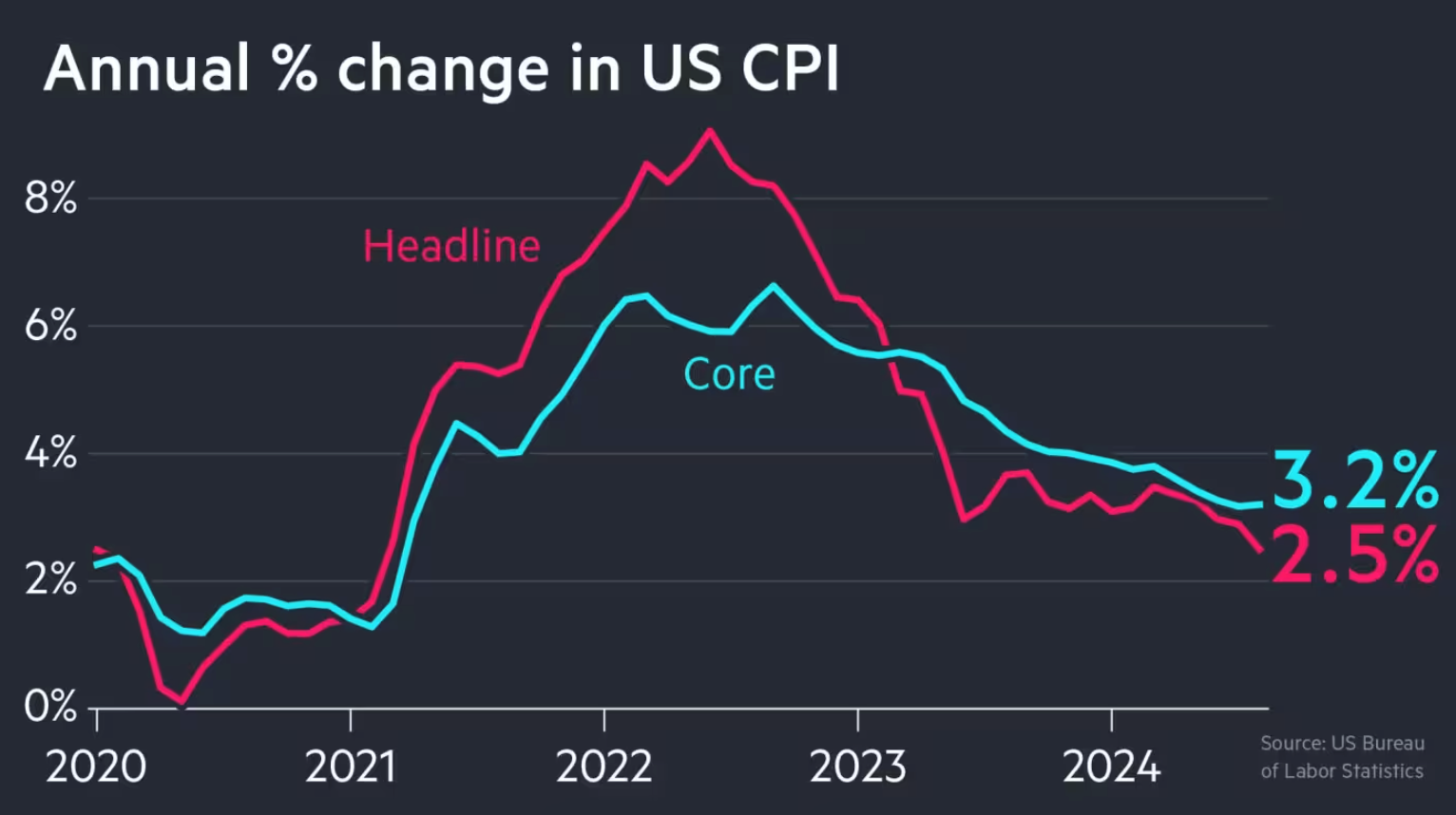

Headline inflation in the US has normalised to 2.5%, with core inflation sitting at 3.2% in the US and 3.4% in Australia. Core inflation is the figure central banks follow to manage interest rates, and they adjust rates to keep inflation within the 2-3% p.a. range.

However, the assumption that inflation normalising to the 2-3% range will automatically lead to official interest rates falling from around 5% to 2-3% is inherently flawed and lacks precedent in modern monetary practice over the past several decades. The only scenario where we see rates falling to 2-3% would be during a recession, with unemployment rising to around 6%. That is not the case right now; in fact, the US and Australian economies continue to grow, and unemployment remains generationally low.

That said, it is reasonable to expect some easing of official interest rates, or "normalising," over the coming six months. This process has already begun. The US central bank has started to cut interest rates, expecting core inflation to fall within the 2-3% range in the coming months and into 2025. As a result, the US central bank has lowered its official rate from 5.5% to 5% p.a.

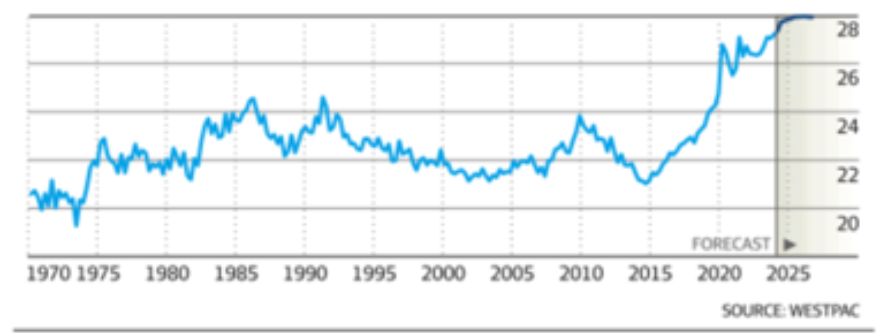

Australia's RBA is reluctant to cut rates at this stage, as it feels it needs to see further declines in core inflation before considering rate cuts. The RBA is also quite aware that the Australian government is injecting record amount of spending into the economy through infrastructure projects, subsidies to households, and aged and disability care payments. These factors are absorbing labour, capital, and materials from the private sector, causing inflation in the services sector to remain quite sticky.

China is a wildcard for Australia. If China's economy continues to slow and falls into a recession, that will quickly shift the interest rate dynamics to the downside in Australia for the reasons discussed in the next section. This is a major reason why we are cautious about Australian equities right now and are positioning defensively in asset allocations.

For now, outside of China risk, the bottom line from an investment perspective is that it is unlikely interest rates will fall significantly, given that economic activity has not slowed down enough to warrant very low interest rates. Australians should expect a small 0.25% rate cut early in 2025; however, that would still mean the official interest rate would be around 4.15%, and the average mortgage and business loan rates would be close to 6% p.a.

This is not much cause for celebration for borrowers, but it is certainly good news for retirees, who deserve a respectable return on their hard-earned savings, whether through bank deposits or lending directly to companies via credit exposures in investment portfolios.

Additionally, the risk of the Middle East war escalating and cutting oil supplies is pushing up oil prices again. This remains a near-term risk of inflation spiking back up, which could result in interest rates remaining on hold for longer, or even increasing, in the event of protracted spikes in oil prices.

Figure 4: US Inflation rate is normalising

Figure 5: Australian government spending as % of GDP at record level not seen since 1970

CHINA ECONOMY CONTINUES TO SLOW - MATERIAL RISKS FOR AUSTRALIAN ECONOMY AND RESOURCES STOCKS

The Middle Kingdom's economy has doubled down on its efforts under President Xi since 2012 to become a decisively export-oriented economy, just when it should have shifted to a more balanced approach between exports and domestic consumption.

Over the past 20 years, China's huge income from exports has gone into savings in Chinese banks. These savings were then intermediated by the banks as loans for infrastructure development and residential property development/mortgages. What the Chinese government should have done, instead of pursuing this increasingly risky and single-minded strategy of depending on the world to continue absorbing China's expanding industrial output, was to gradually encourage the growth of the domestic consumption economy to support domestically focused industries and sectors.

Export dependence and the recycling of export income into expanding the industrial base became a self-fulfilling circular loop over the past two decades. Worse still, new investments going into both infrastructure and residential property became increasingly uneconomic and speculative. While China's exports have continued to grow post-COVID-19, helping to perpetuate this lopsided economic model for a while longer, the risks are now clearly emerging as advanced economies clamp down on Chinese exports by enacting high tariff walls and outright sanctions in many cases. This will cause a gradual slowdown in export income for China and exacerbate the economic slowdown and asset price deflation, as income from uneconomic domestic assets will not be sufficient to substitute the loss of export income.

This is the debt-deflation trap in China that needs to be closely monitored, as it also poses a material risk to Australia’s economy, with China being its largest trading partner and no other partner able to quickly take its place. Secondly, iron ore is Australia’s largest export to China. Iron ore and coking coal, two main ingredients for China’s steelmaking, drive the valuation of much of BHP, RIO, and Fortescue, which comprise the majority of the resources index, making up 20% of the Australian share market weight. When only 1% of China's 250 steel manufacturers are currently profitable, it is clearly a worrying sign for the sustainability of China’s steel industry, which relies on our iron ore exports. The resources sector could struggle next year, and with banks comprising 30% of the Australian share market and having already rallied in double-digit percentages in anticipation of a "happy-days-are-here-again" scenario, it will be difficult to see how the rest of the Australian market can grow robustly next year. This is particularly true when two of the major sectors of the index face challenges—one with a negative catalyst (resources) and the other without a strong positive catalyst (banks).

In fairness, the Chinese government is trying to support its economy, but it is not addressing the root cause of supporting domestic welfare and domestic consumption with any great conviction. We suspect it probably can't because making a rapid policy shift to encourage people to draw down on their savings to consume would result in a massive collective withdrawal from the banking system, which has already lent these savings to property and infrastructure assets. Who is going to buy those non-performing property assets to help banks fund the cash call from savers? And even if there are buyers (mind you, foreign buyers are spooked by geopolitical risks), the collective selling pressure would push property prices down even further.

This predicament is similar to what Japan experienced after its economic/property bubble popped in the late 1980s. We will discuss the parallels to Japan at another time.

FINAL WORD

So, there you have it, these are the major themes circulating in our minds that we wished to discuss in this letter. Ultimately, we refer you back to Figure 2 above and remind investors that the purpose of this discussion is to help us navigate the short-term ebb and flow of risks and opportunities in the markets, and how we can tilt portfolio allocations to generate some excess returns along the way while lowering portfolio volatility to the extent possible.

The time-tested rule of investing remains fully intact: a combination of equities and credit will deliver solid returns for investors over the long term.

As always, remain diversified, exercise patience and be curious…