Insights & Commentary

Welcome to the December Quarter update

PERFORMANCE REVIEW OF 2024

It has been a good year for our clients and investors alike.

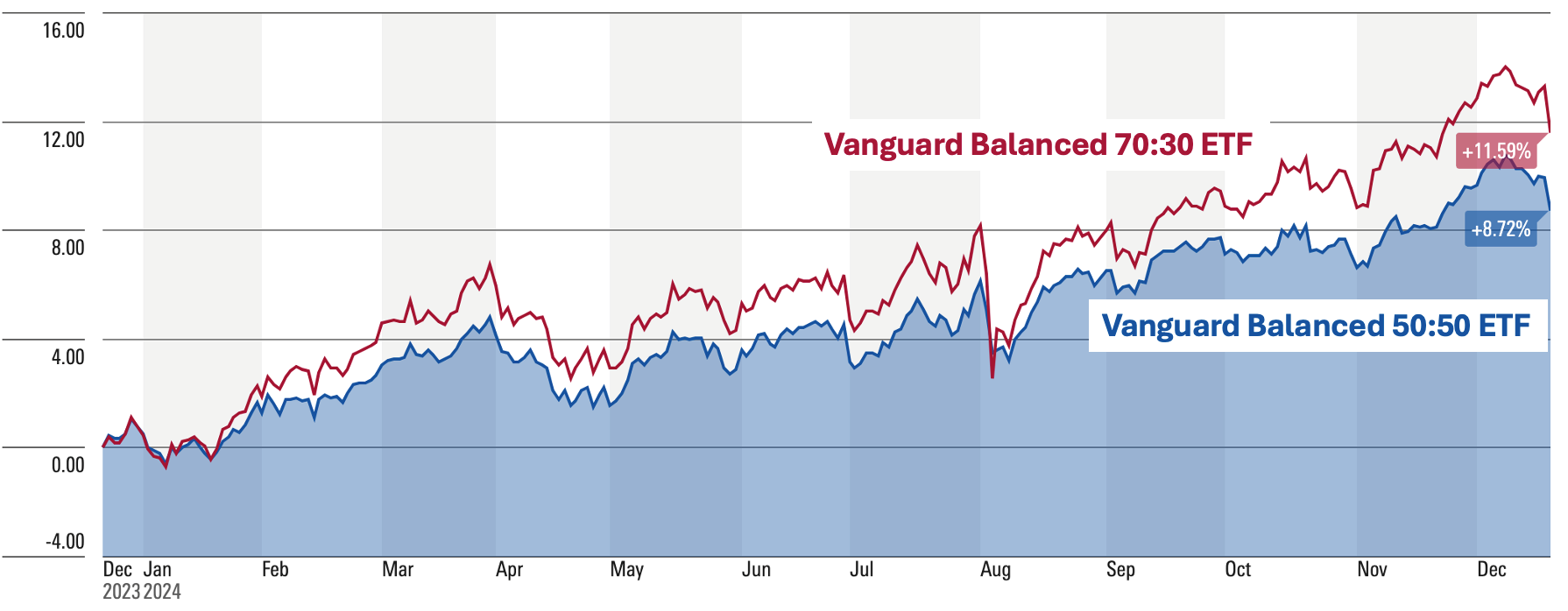

Shown below are the price-based returns over the past 12 months for the benchmark Vanguard diversified portfolios for the Balanced and Growth risk profiles. Were pleased to see the vast majority of our clients outperform these results with lower levels of volatility.

Source Morningstar: Gross Returns based on price growth, excludes dividends. As at 19 December 2024

Source Morningstar: Gross Returns based on price growth, excludes dividends. As at 19 December 2024

Our edge over the benchmarks has been driven by US-centric, technology-focused, and currency-unhedged exposures over the past year. Our tilt towards global technology stocks and maintaining an unhedged exposure to the US dollar in global shares have been decisive choices in achieving outperformance.

Our exposure to gold has also been a key driver of excess performance.

Our fixed interest exposures, on average, have delivered between 5-7% across portfolios indicating strong credit outcomes.

Tactically, we adjust portfolios by modifying asset allocation, selecting individual investments, rebalancing, and other strategies. These adjustments respond to our assessment of near-term risks and opportunities in specific asset classes, with the intention of outperforming our stated return goals. Year 2024 was positive in this regard.

2025 - A PIVOTAL YEAR

Markets value nothing more than positive catalysts for revenue and earnings growth. Ultimately, nothing impacts share prices (and investment returns) more than economic, political, technological, and social triggers that accelerate the revenue and earnings growth of businesses.

Looking ahead to the coming months, there are really only two major near-term catalysts for the economy and share markets: Donald Trump and interest rates. Not much else comes close—not even AI.

Catalyst 1 - Donald Trump

With Donald Trump, we effectively have a businessman, along with his close associates, taking the reins of the most powerful country in the world. He has been re-elected with a strong mandate, and this time he is expected to make sweeping changes to the deep state machinery. These factors should combine to fuel the rapid implementation of Trump’s economic priorities.

Trump’s key economic priorities are as follows, and they are being well-received by U.S. business leaders and markets:

Deregulation: Trump emphasizes the need to eliminate job-killing regulations, proposing a rule that for every new regulation introduced, ten old ones must be removed. This initiative is aimed at fostering a more business-friendly environment.

Tax Cuts: Trump plans to implement historic tax cuts for American families, workers, and businesses. His proposal includes reducing corporate tax rates from 21% to 15% to encourage investment in the U.S.

Investment Incentives: Businesses investing $1 billion or more in the United States will be eligible for expedited permits and approvals from the federal government, including environmental clearances.

Energy Independence: Trump advocates for leveraging America’s vast energy resources by expediting approvals for pipelines and drilling projects while promoting clean coal technology. His goal is to lower oil prices to around $40 per barrel from the current highs of $70 per barrel, reducing costs for both industry and households.

International Relations Focused on Peace: Trump envisions U.S. leadership that promotes global peace while addressing conflicts such as those involving Israel and Ukraine.

What this means is that no other liberal democratic country currently has an economic agenda as strong and clear as the United States. As a result, global capital is likely to flock to this opportunity. Capital seeks reduced red tape, political support, lower costs of doing business, and sizeable economic opportunities—all of which the U.S. offers right now.

For these reasons, we expect the U.S. stock market to outperform all other global markets over the next four years.

Catalyst 2 - Interest Rates in Australia

Interest rates can only act as a catalyst for Australian corporate earnings and households if they are significantly reduced from current levels. However, based on the current outlook, that is unlikely to happen. As such, this catalyst remains weak at best for the domestic Australian economy.

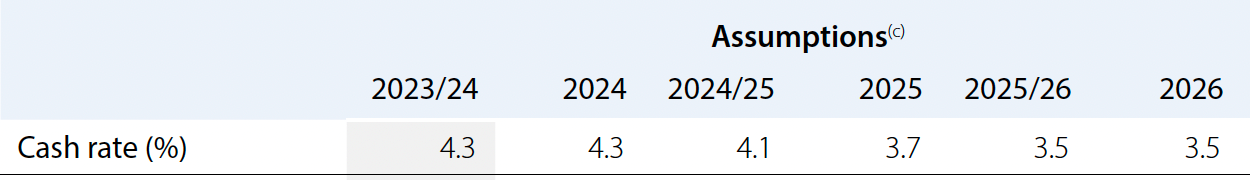

The Reserve Bank of Australia (RBA), despite its history of inaccuracies in forecasting interest rates, currently projects a decline of just 0.8% in Australian interest rates over the next two years. This implies that the average mortgage rate, currently at 6.3%, will still be approximately 5.5% by December 2026. While this reduction will ease repayment burdens on households to some extent, it is hardly cause for celebration.

The primary reason Australia is not seeing significant rate cuts, while other major central banks are gradually reducing rates, is that the RBA did not raise rates as aggressively as its global counterparts. Additionally, record government spending on infrastructure projects, healthcare, social care (including disability and aged care), and economic relief subsidies will likely remain the key drivers supporting the Australian economy through 2025. These factors have also been the largest contributors to job growth in Australia in recent years.

What this means is that Australian shares are expected to deliver low growth and remain predominantly a dividend-focused story next year. However, credit markets in Australia are likely to continue providing solid income returns of around 6%.

Source: RBA Statement of Monetary Policy November 2024

Source: RBA Statement of Monetary Policy November 2024

CONCLUSION

Our asset allocation remains defensive by 5-10% relative to growth for each risk profile. This reflects our response to equity valuations being well above their historical averages. We also maintain the view that there is no need to overly tilt portfolios toward growth after the strong performance of the past year, particularly when defensive credit is delivering a respectable 6% p.a. income, supported by a stable domestic interest rate outlook.

We will continue to share our most immediate views through commentary provided in your individual client reviews.