Insights & Commentary

Market Update - March Quarter 2024

Welcome to our investment update for the Market Update - March Quarter 2024

Global share markets have continued to enjoy robust investment returns, as illustrated below.

Figure 1: Performance of key stock markets over March quarter

Figure 1: Performance of key stock markets over March quarter

Both European and US stocks, which constitute the majority of our international exposure, have consistently delivered double-digit returns. Initially, this surge was largely attributed to global technology stocks (Amazon/Google/Apple), but the rally has since expanded across a broad spectrum of sectors. The optimism fuelling this surge in prices is largely due to the anticipation of interest rate cuts in the near future and the widespread belief that the US economy will sidestep a recession.

In the major markets of Asia, Japan and India have shown impressive rallies over recent quarters, while China's market is experiencing fluctuations near its lows after last year's decline.

The Chinese share market is in search of firm conviction regarding its domestic economic growth prospects. The question remains whether it can sustain growth amid numerous challenges, such as a heavily indebted property market and diminishing export income, partly due to US sanctions.

At this point for us investors, having enjoyed the solid returns in international shares, it's worth recalling an old market saying: ‘rapidly increasing stock prices turn holding stocks into a riskier endeavor, with the expected near-term returns diminishing’, assuming all other factors remain constant.

So, what are we to do with our portfolio allocations in the coming months? This is the question we will explore in the following sections.

Is the Australian Stock Market Overvalued?

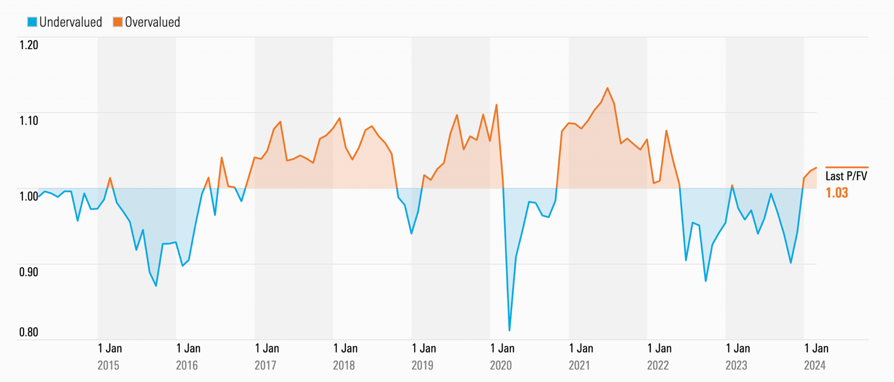

The Australian stock market is showing signs of being overvalued, as demonstrated by the chart provided below.

Figure 2: Is the market cheap or expensive? Australian Share Market Price to Fair Value ratio

Figure 2: Is the market cheap or expensive? Australian Share Market Price to Fair Value ratio

When the share market trades above the horizontal benchmark of 1.0, marked in orange, it indicates that shares are priced higher than their underlying fair value. The fair value is predicated on projected future earnings, and currently, the market seems to be entering into overpriced territory.

However, historical trends revealed in the long-term chart in Figure 1 above indicate that the market can remain in either undervalued or overvalued zones for substantial periods—typically between one to two years—before undergoing a correction.

In response to these market dynamics, our portfolio management approach involves actively harvesting profits and reducing our stake in stocks to levels below our strategic asset allocation when they are in the overvalued zone, as highlighted in orange. That being said, when applicable, we will still aim to rotate profits from over-priced stock positions to under-priced stocks as we are currently seeing opportunities in Australian stocks specifically amongst the industrials and over-sold materials stocks.

Conversely, when stocks are deemed undervalued, highlighted in blue, we strategically increase our investment to capitalize on potential value. This rebalancing strategy aims to optimize returns while managing risk in fluctuating market conditions.

Are International Stock Markets Overvalued?

Currently, the majority of most liquid global stock markets are trading in territory deemed overvalued, with the UK, Germany, and China being the exceptions. These markets are notably trading at levels that represent a substantial discount to their assessed fair value.

In the upcoming reviews, we may strategically adjust our international exposures to add some diversified exposure to the undervalued UK and German stock markets, reallocating some profits from the overpriced US and certain Asian markets. From our perspective, China remains out of our favour due to the political risks associated with its market, which we currently view as not worth taking.

Where are interest rates going next?

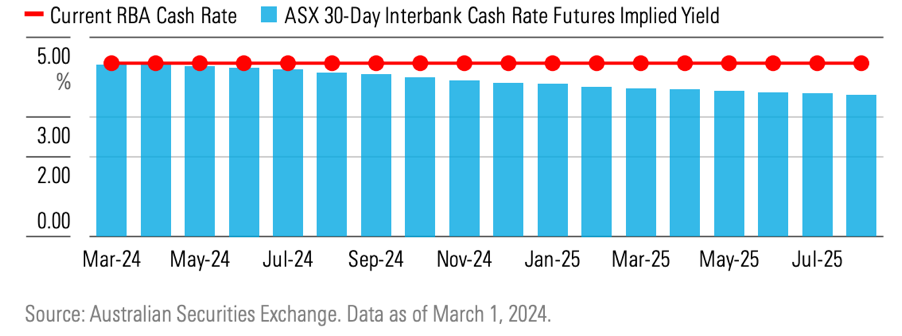

The chart below shows market’s expectation of when interest rates will start to be cut in Australia.

At current forecasts, we are looking at rates starting to be trimmed from September 2024.

The current RBA official interest rate is 4.35% and by September 2024 the market expects it to reduce to 4.15%.

By late 2025, the market expects the cash rate to reduce to 3.55%.

Figure 3: ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve

Figure 3: ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve

These projected falls in interest rates are clearly not expected to be massive, in fact less than 1% from the current peak. What that means is that borrowers (corporates and households) holding out for a significant reprieve from the RBA are unlikely to get it based on current estimates.

If this interest rate forecast plays out in reality, then the average mortgage interest rate in Australia will still be +5.5% late next year!

This of course is great outlook for defensive investors and self-funded retirees as this higher-for-longer interest rate outlook gives them an opportunity to continue earning decent income return through credit/bond investments (+5.5% p.a.) without taking undue risk of investing in shares which in many instances are trading above fair value.

Additionally, given our expectation since last year that average interest rates will likely remain higher for longer, as a result we have been suggesting to trim exposure to stocks that carry higher levels of debt particularly infrastructure companies.

Why are interest rates likely to remain higher-for-longer?

The Australian government is investing a significant amount of money in two sectors in particular, namely aged care and disability care (NDIS), which are drawing labour from other sectors and contributing to an increase in services inflation (wages growth).

The demand for services due to a rapidly aging population (perhaps left more vulnerable after COVID-19) is surging. There simply aren't enough government-funded dollars (and labor) to meet the growing need for community assistance. The situation for disability care is perhaps even more dire.

In 2021, a total of $23.6 billion was spent on aged care, which increased to $24.8 billion in 2022 and $27.1 billion in the last financial year of 2023, with aged care expenditure expected to reach $42 billion by 2027! This implies a growth rate of aged care expenditure in Australia of approximately 10-11% per annum. That’s significant.

Similarly, according to Australia’s 2023 budget papers, the total expenditure from the Commonwealth and the states and territories on the NDIS (disability care services) is estimated at $36.7 billion in 2023 and is expected to reach $41.9 billion in 2024, a growth rate of 14.4%. In the subsequent three years, the annual growth rates are projected to be 11.6%, 10.9%, and 7.9%, respectively. We expect these forecasts to exceed initial expectations if past inaccuracies in forecasts are any guide.

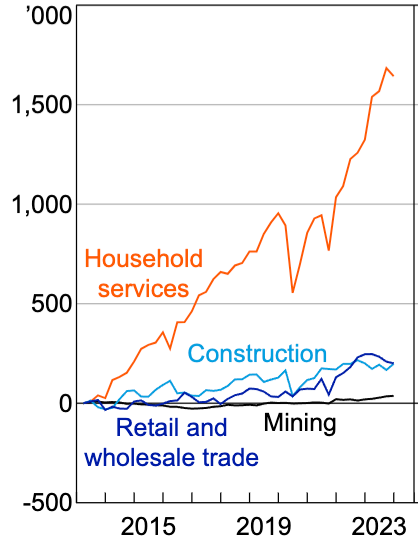

The government will fund these social services regardless of the short-term state of the economy and continue to generate employment and fund wages growth as it has over the past ten years, as illustrated by the chart below.

The chart clearly demonstrates that Australia’s job growth over the past decade has predominantly come from household services, mainly disability care, aged care (residential and home care), and child care services (another government-funded service). Compared to the Household Services, the rest of the economy has seen relatively limited employment growth.

Figure 4: Employment Growth by Industry

It is thus not entirely surprising that Australia’s unemployment rate remains at a record low of 3.8% and wages growing at 4.2% in Feb 2024 which is much higher than past average of 2%.

The RBA (Reserve Bank of Australia) is forecasting the unemployment rate to rise to 4.7% by March 2025, which would still be well below the pre-COVID-19 levels.

The aged care workers' union recently secured an 18-28% pay raise for aged care workers, which will contribute to core inflation from 1 July 2024, as will the further tax cuts expected on the same date. Additionally, the annual population growth hit 2.5% in the latest data released in March 2024 – the highest rate since 1952.

All this suggests ongoing upward pressure on core inflation and pressure on available housing stock leading to further increase in rents.

Why may Australia’s House Prices Rise in 2024?

There is a compelling argument presented in the book titled 'The Great Housing Hijack – 2024,' suggesting that a key factor in house price growth in Australia is rental growth.

The book establishes a connection between growing household disposable incomes and rent increases, highlighting that this link has remained quite steady over past decades.

In Australia, the ratio of average rent to disposable income for households renting in the private market was approximately 20% in both 1993 and 2023, when rounded to the nearest whole percentage. The book further asserts that house prices are not linked to unemployment rates.

This analysis offers hope that, with household disposable income expected to rise from tax cuts, wages continuing to grow at above 4%, and strong employment figures, we should expect to see positive growth in both rents and house prices in 2024 in order to maintain the above ratio at 20%.