Insights & Commentary

Investment Letter – July 2025 Casting Off the Moorings

PERFORMANCE REVIEW OF 2024

The overall performance of Sovereign’s clients’ portfolios continues to show steady growth at a time when markets remain highly uncertain due to global political developments and short-term volatility in inflation and interest rate expectations.

We design clients’ portfolios to better absorb near-term market fluctuations while staying aligned with compelling investment opportunities supported by powerful, long-term growth drivers.

Our commitment remains clear: to capture long-term total returns while managing the inevitable ups and downs of market cycles.

FULL-YEAR EARNINGS SURGE LED BY TECHNOLOGY GIANTS

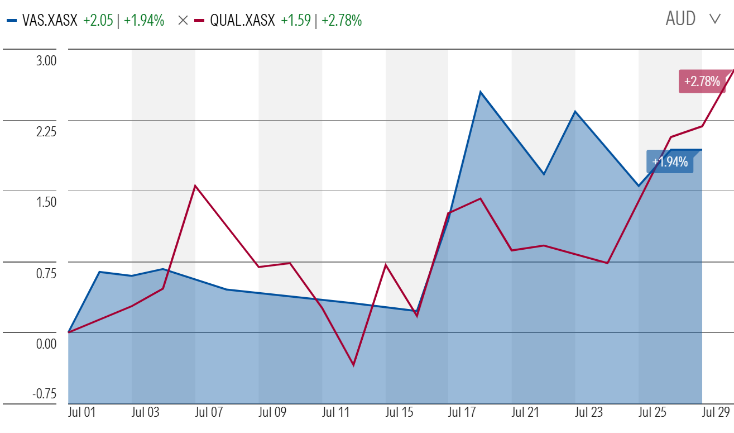

The figure below shows market movements over the four weeks of July.

Figure1: Australian (VAS ETF) and Global (QUAL ETF) Share Market Performance – July

Source Morningstar

Source Morningstar

The first two weeks of July saw largely flat performance across client portfolios as guided by the broad market movements shown in Figure 1 above. This reflected market caution ahead of the U.S. and Australian corporate earnings reporting seasons for the quarter and financial year ending 30 June 2025.

From mid-July to month-end, markets rallied on the back of strong earnings and investment updates—particularly from U.S. technology leaders. A May 2025 McKinsey report estimates the infrastructure required to support artificial intelligence will cost A$10.3 trillion over the next five years—an extraordinary figure over such a short horizon. Importantly, this investment wave is starting to translate into measurable revenue and earnings growth.

Microsoft is monetising AI through its enterprise productivity tools, particularly Microsoft 365 Copilot, which is being adopted by corporate clients at premium pricing. This is driving incremental revenue in its Office Commercial segment. More significantly, Azure’s AI services are fuelling robust growth in Microsoft’s cloud division, with AI workloads accounting for a rising share of new enterprise deployments—contributing to 17% year-on-year Azure revenue growth. As we discuss later in this letter, we believe Microsoft is well positioned to emerge as a long-term leader in AI, with a potential growth trajectory ahead of its peers.

Meta (owner of Facebook, WhatsApp, Instagram) is using AI to enhance advertising efficiency and user engagement. Its AI-powered Advantage+ tools are enabling advertisers to achieve higher returns on ad spend, contributing to a 27% increase in ad revenue. AI-driven recommendation systems are also increasing time spent on Facebook and Instagram—benefiting monetisation and retention, though in our mind this ought to raise concerns about long-term productivity and mental health of users of Meta’s apps.

Investor scepticism that the current AI investment surge might be speculative is, so far, being proven wrong. The earnings uplift is tangible, and markets have responded with a strong rally in technology stocks.

Our exposure to global technology stocks, typically, is via the VanEck MSCI International Quality ETF (QHAL), the Vanguard MSCI International ETF (VGAD), Munro Global Growth Fund, and T Rowe Price Global Equity Fund

Figure 2: Top 10 Positions in Vaneck MSCI Quality ETF (QHAL) are Mostly Technology Companies

Figure 2 shows that seven of the top ten positions in QHAL ETF are mega-cap technology firms—Nvidia, Microsoft, Apple, Alphabet, Meta, and others. These companies have delivered strong returns over the past 12 months, driven largely by expectations of sustained earnings growth tied to a historic surge in technology investment—particularly in AI..

Earnings growth typically follows capital investment. We are now entering what could become one of the largest—if not the largest—global capital expenditure (capex) cycles in history, driven by AI-led transformation and likely still in its early stages. The potential demand for AI to analyse, recommend, and even control real-world actions and tasks is vast. As discussed in the Book Review section of this letter, an Oxford economist argues that the future of economic growth may shift from relying on the transformation of physical goods — inherently limited by the availability of physical commodities and labour — into higher-value physical products, toward the potentially infinite production of intangible virtual goods based on data, knowledge, ideas, AI, graphics, and sound

The challenge—and opportunity—lies in building commercial models that customers, both individuals and businesses, are willing to pay for, while ensuring adequate and equitable participation of labour in the wealth and income generated, so that they can afford, benefit from, and have ownership in these intangible goods. Encouragingly, early adoption trends are strong.

For investors, the central question is whether this investment wave will translate into durable, monetisable earnings. If it does not, markets risk an “earnings-light” boom that could unwind sharply—similar to the dot-com collapse of the early 2000s.

Conversely, if capital is deployed effectively and earnings follow, this investment cycle could underpin a multi-year rally in U.S. technology stocks, eventually extending to companies in other sectors that apply AI to lift revenues, reduce costs, or both. However, like with all previous booms in history, there will be individual corporate failures along the way in this AI boom. Time will separate the winners from losers.

From our perspective, we have and continue to diligently take profits in technology stocks while still recognising that the balance of risks and opportunities tilts in favour of ongoing participation in technology theme, though we maintain a measured allocation within a diversified portfolio to avoid excessive concentration in any single theme

Our thematic allocations to climate change, healthcare, global consumer brands, and Australian and Indian equities further broaden our exposure and enhance diversification.

In fact, the next section discusses new positions we have been considering for addition to portfolios, which are not technology stocks.

SOME NEW POSITIONS BEING CONSIDERED FOR PORTFOLIOS

In this section, we outline four new positions we have been actively considering for presentation to you during portfolio reviews. The list is not exhaustive but illustrates a number of opportunities we continue to research and recommend for inclusion in portfolios.

These forces are converging at once and amount to trillions of dollars in anticipated investment over the next 5–10 years. Such activity should spur general economic growth, prompting us to consider shifting more of our cash holdings to growth assets to benefit from these opportunities.

Overall, we remain defensively positioned in growth assets at levels appropriate for each risk profile, and short-term volatility management continues to be our core portfolio management principle.

Over the past nine months, we have maintained higher cash levels as a cautionary measure to navigate the economic uncertainties we anticipated during this period—uncertainties which indeed materialised.

However, looking ahead, we expect these uncertainties to reduce from the above-normal levels of the past nine months, warranting a measured deployment of some of our excess cash reserves.

Some new positions we have been considering are as follows:

- VanEck Australian Property Stocks ETF

- James Hardie, a US housing recovery–related stock

- An ETF focused on global quality small companies

- A South Korea stocks ETF - as investment flows to emerging markets should rise

All of these positions are appealing from a long-term return perspective.

We provide further details on these positions in the section below.

1. James Hardie PLC (ASX:JHX)

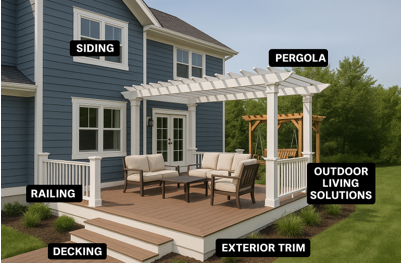

James Hardie Industries, a 135 year old building products leader originally founded in Australia and now registered in Ireland, has evolved into the dominant global producer of fibre cement siding and exterior materials. With around 90% market share in the U.S. fibre cement category, the company generates about 80% of its operating income from North America, primarily in the repair-and-renovation (R&R) segment—a structurally resilient market given that roughly half of all U.S. homes are now over 40 years old and will require re-siding in the coming decade. Hardie’s portfolio, strengthened by its USD 8.4 billion acquisition of AZEK (decking, railings, and pergolas), positions it as a full-service exterior and outdoor living solutions provider.

Figure 3: James Hardie’s Products

The company’s wide economic moat is built on brand reputation, cost scale, R&D leadership, and a track record of steadily taking share from cheaper, less durable materials like vinyl and wood, despite its premium pricing.

Following the AZEK acquisition, Hardie shifted to a primary New York Stock Exchange listing (JHX), though it continues to maintain its ASX listing and compliance with Australian rules.

Looking ahead, falling interest rates and a broadly supportive economic environment create a favourable backdrop for James Hardie’s growth. Lower mortgage costs are likely to support new home construction and unlock delayed renovation spending—key tailwinds for Hardie’s core markets in siding and outdoor living.

This cyclical upswing is expected to reinforce the company’s strong underlying fundamentals: a growing mix of higher-margin architectural and pre-painted products, ongoing R&D-led innovation, and scale efficiencies that support margin expansion from 28% to a forecast 33% by 2035.

Financial leverage is expected to peak at 3.4× net debt/EBITDA in 2026 but return to under 2× within two years, aided by strong cash generation and disciplined capital allocation, balancing reinvestment with buybacks.

For our portfolios, Hardie offers a compelling combination of defensive cash flow from R&R, cyclical upside from housing recovery, and long-term growth through category expansion and product leadership.

2. VanEck Australian Property ETF (ASX:MVA)

With interest rates set to ease by approximately 1% in Australia, we are actively seeking alternative yield-enhancing opportunities to complement our investment in the AAA Cash Term Deposit ETF. While the AAA ETF has delivered an attractive income of 4.4% p.a. over the past couple of years, we anticipate this will decline to around 3% p.a. over the next 12 months.

Considering this, we intend to begin reallocating some of the funds currently invested in AAA into ASX-listed property stocks, which are currently underweight in our portfolios at 3% of total allocation. Our objective is to increase this exposure by a further 3%, taking the total property weighting to 6% of the overall portfolio.

Specifically, we plan to increase our allocation via the VanEck Australian Property ETF (ASX: MVA), which offers diversified exposure to high-quality Australian Real Estate Investment Trusts (A-REITs). This dividend-focused ETF is expected to provide a balanced return profile, with approximately 5% p.a. income and 3% p.a. capital growth.

In a declining interest rate environment, A-REITs are well positioned to benefit from rising earnings and distributions to shareholders. Consumer spending recovery is expected to deliver stronger rental performance in retail shopping centres, while residential developers such as Stockland and Mirvac are expected to benefit from improved mortgage affordability and increased transaction volumes. Meanwhile, office assets are also beginning to show early signs of recovery.

3. MSCI South Korea ETF (ASX: IKO)

South Korea presents a compelling medium-term investment opportunity driven by the new administration’s focus on structural corporate governance reform, aimed at dismantling the long-standing "Korea discount" and lifting equity valuations closer to global peers (Korea PE 9x vs Japan's 13.7x currently).

President Lee Jae-myung’s Democratic Party holds legislative control and is pursuing legally binding corporate governance reforms — including fiduciary duties to shareholders, stronger minority shareholder rights, stricter audit oversight, and limits on treasury share abuses (historically, a source of management trickery to maintain control over companies and veto shareholders) — addressing structural conflicts that have historically suppressed valuations.

Improved governance frameworks may draw significant foreign institutional capital, reversing years of relative underweight positioning in South Korea.

4. VanEck MSCI International Small Companies Quality (AUD Hedged) ETF (ASX: QHSM)

We have initiated a position in the VanEck MSCI International Small Companies Quality (AUD Hedged) ETF (ASX: QHSM). We tend to lean into global small cap stocks when we believe the economic cycle is set for another round of multi-year growth.

The fund provides exposure to 150 developed-market small-cap companies (ex-Australia) that score highly on MSCI’s quality metrics — high return on equity, stable earnings, and low leverage — with the portfolio fully hedged back to AUD.

This targeted factor approach aims to capture the earlier-stage profit cycles of small caps while maintaining a quality discipline that historically reduces share price sell offs compared to the broader small companies’ universe.

The Australian Dollar (AUD) hedge removes currency volatility from the return stream, allowing the investment case to rest squarely on business and factor performance.

We see QHSM as a satellite allocation complementing our core global equity holdings. It offers diversification away from large-cap concentration, a tilt towards companies with resilient balance sheets and consistent earnings profiles, and a disciplined, rules-based structure.

While small caps remain inherently more volatile and the quality style can lag in markets favouring highly leveraged or unprofitable companies, we believe the combination of quality screens and currency hedging creates an attractive way to participate in global small-cap earnings growth while managing risk.

MARKET OUTLOOK

ARTIFICIAL INTELLIGENCE – A LONG-TERM TREND

First Came - The Internet Browser

The invention of the internet browser, one of the most important inventions of late 20th century, transformed the internet from a specialised tool for academics and technicians into a universal platform (a singular window to the world wide web) for communication, commerce, and knowledge.

Before the internet browser, users, including yours truly, would have to type out the commands on a blank computer screen (no graphics). It was mainly used for file sharing and totally unfit for the general public use.

Then came the first wave of internet browsers, Mosaic (1993), Netscape Navigator (1994), and Internet Explorer (1995). These web browsers opened the internet for non-technical general audience by combining text, images, and later audio and video into a single, navigable interface. These browsers allowed anyone with a computer to explore information, connect with others, and transact online without needing technical expertise. The simple act of clicking a hyperlink opened the door to “surfing the web,” making the world’s information accessible to a global audience.

Beyond accessibility, browsers standardised the web through support for universal protocols like HTML and HTTP, enabling developers worldwide to create content and services that could be reached by anyone, anywhere. This foundation not only powered the rise of e-commerce, online media, and social networks, but also created the gateway for cloud software, online banking, and digital learning.

In this way, the web browser stands as one of the most important inventions of the modern era — the tool that truly brought the internet into everyday life.

Second Came – The Search Engine

Search engines were the next critical step in making the internet truly usable. They removed the need to know exact web addresses, allowing users to simply type a query and instantly receive a list of relevant results. In doing so, search engines organised the rapidly expanding web, brought choice to users, and made it fully navigable through browsers. Early standouts included AltaVista (1995), Yahoo (1995), and, ultimately, Google (1998), which set the standard for speed, relevance, and ease of use.

Third Came – The Smart Phone

The smart phone made multi-media access to the web something you could carry in your pocket. It turned connectivity to the internet, entertainment, and e-commerce into everyday essentials — so much so that we can hardly imagine life without them.

Smart phones also drove an explosion in the creation, use, and storage of data in quantities almost impossible to comprehend. This demand for data storage and high-speed transfer over the internet pushed the growth of global data centres, mobile networks, and cloud computing — laying the foundation for today’s always-on, increasingly AI-powered digital world.

Fourth Came – The Artificial Intelligence (AI)

Just as search engines once organised the chaotic proliferation of web content, making the world’s information accessible and usable, artificial intelligence is emerging as the solution to an even greater challenge: the sheer scale and speed of information creation today.

Every second, data is generated by individuals, companies, and machines at volumes no human could ever hope to analyse manually. AI can map the entirety of recorded human knowledge and process it to deliver precise, relevant answers — in seconds. And because each interaction creates new data, AI continuously learns and improves, expanding both the quantity and quality of insights it can deliver.

At the heart of this transformation are large language models (LLMs), trained on vast datasets to understand and generate human-like responses. OpenAI — best known for ChatGPT — pioneered this trend, and Microsoft’s early, exclusive partnership with OpenAI has given it a significant first-mover advantage in delivering AI capabilities to enterprise and government clients.

History shows that in platform shifts — from browsers to search engines — the market leader often captures the lion’s share of long-term value. At present, Microsoft and OpenAI are setting the pace, with other major players such as Google, Amazon, and Meta pursuing their own strategies. While we see Meta as focused on personal-use AI embedded in social media, Microsoft’s positioning is far broader, offering structural, long-term revenue opportunities tied to productivity, workflow automation, and decision-making tools for global organisations.

We will be keenly watching how this thesis on Microsoft translates into its share price growth over time. Early signs are encouraging per Figure 4 below.

Figure 4: Meta and Microsoft Share Prices Lead in 2025

BOOKS & INTERVIEWS

Growth – A History And A Reckoning

By Danial Susskind

Daniel Susskind’s Growth: A History and a Reckoning (2024) is an incisive examination of humanity’s defining pursuit—economic growth—and its complex, often contradictory relationship with progress, particularly in the age of advanced technology. Susskind moves beyond the traditional view of economic growth as an unqualified good, framing it instead as a profound dilemma in which its “promise” carries an “enormous price.” He makes a compelling case for rethinking how we conceive, measure, and—most importantly—direct economic growth to manage technology’s impact on society

Susskind begins by tracing the “mysterious past” of growth. For most of human history—roughly 300,000 years—economic life was stagnant, defined by a relentless struggle for subsistence. The “escape” from this Long Stagnation began only two centuries ago, driven not by simply using more tangible resources (a path blocked by diminishing returns) but by sustained technological progress capable of overpowering those diminishing returns. Susskind stresses that lasting growth “can only come through technological progress.”

At the core of his account is the “power of ideas.” He explains how ideas generate increasing returns and allow humanity to transcend the finite limits of the material world.

To “unleash growth” and spark a Second Industrial Enlightenment, Susskind proposes key interventions to generate more ideas:

- Overhaul Intellectual Property law – Create a “wiser, leaner, and simpler” system that avoids “IP imperialism” and “weaponization” and better serves intangible goods (the future of growth).

- Invest far more in R&D – Reverse national underinvestment relative to leading corporations.

- Expand the pool of innovators – Increase immigration and address inequalities of race, gender, and parental income that waste potential talent.

- Leverage AI in research – Use AI to organise existing knowledge, generate hypotheses, and conduct advanced tasks like protein folding, countering the pessimism about running out of easy discoveries.

But growth’s benefits come with significant costs. The same technologies that fuel prosperity can be climate-damaging, inequality-widening, work-disrupting, and politically destabilising. Susskind warns against myths that machines replace only “dull” jobs as outdated—AI systems like DALL·E and ChatGPT increasingly take on creative, complex tasks, shrinking safe havens for displaced workers.

Susskind argues that falling wages, greater insecurity, and potential job loss as outcomes are not inevitable. Through directed technological change, society can steer the course of innovation—like piloting a boat—by reshaping the incentives that drive it.

To weaken the trade-offs between growth and social well-being, Susskind proposes:

- Taxes and subsidies – Address the bias favouring capital over labour with measures such as “robot taxes” to incentivise worker-complementing technologies.

- Laws and regulations – Close the gap between technological capability and accountability, especially in the “empire of code” (it is a concept that highlights how the rules imposed by increasingly pervasive technologies regulate human behaviour with an intensity and reach comparable to formal, legislative law) shaping democracy and justice.

- Social narratives and norms – Move beyond the “human parity” benchmark in AI, which encourages substitution over augmentation, and promote a vision of “good work.”

This is not a retreat from markets, Susskind insists, but a more intentional use of market mechanisms to pursue socially valuable ends.

Ultimately, Susskind contends that the challenges posed by technology are moral, not merely technical, and demand collective deliberation. He calls for returning these debates to the political sphere, empowering citizens through participatory institutions such as citizen assemblies to decide “what we truly value” and “what we owe the future.” Growth, he concludes, has both irresistible promise and unacceptable price—but it is within our power to choose a different kind of growth and shape our technological future for the better.

IMPORTANT DISCLAIMER – Please read carefully

Disclaimer: The contents herein do not take into account the investment objectives, financial situation or particular needs of any person and should not be used as the basis for making any financial or other decisions. This disclaimer is intended to exclude any liability for loss as a result of acting on the information or opinions expressed. Sovereign Advisors Pty Ltd is a Corporate Authorised Representative No.1240650 of InterPrac Financial Planning Pty Ltd (AFSL 246638).