Insights & Commentary

Market Update - Responding to Inflation volatility

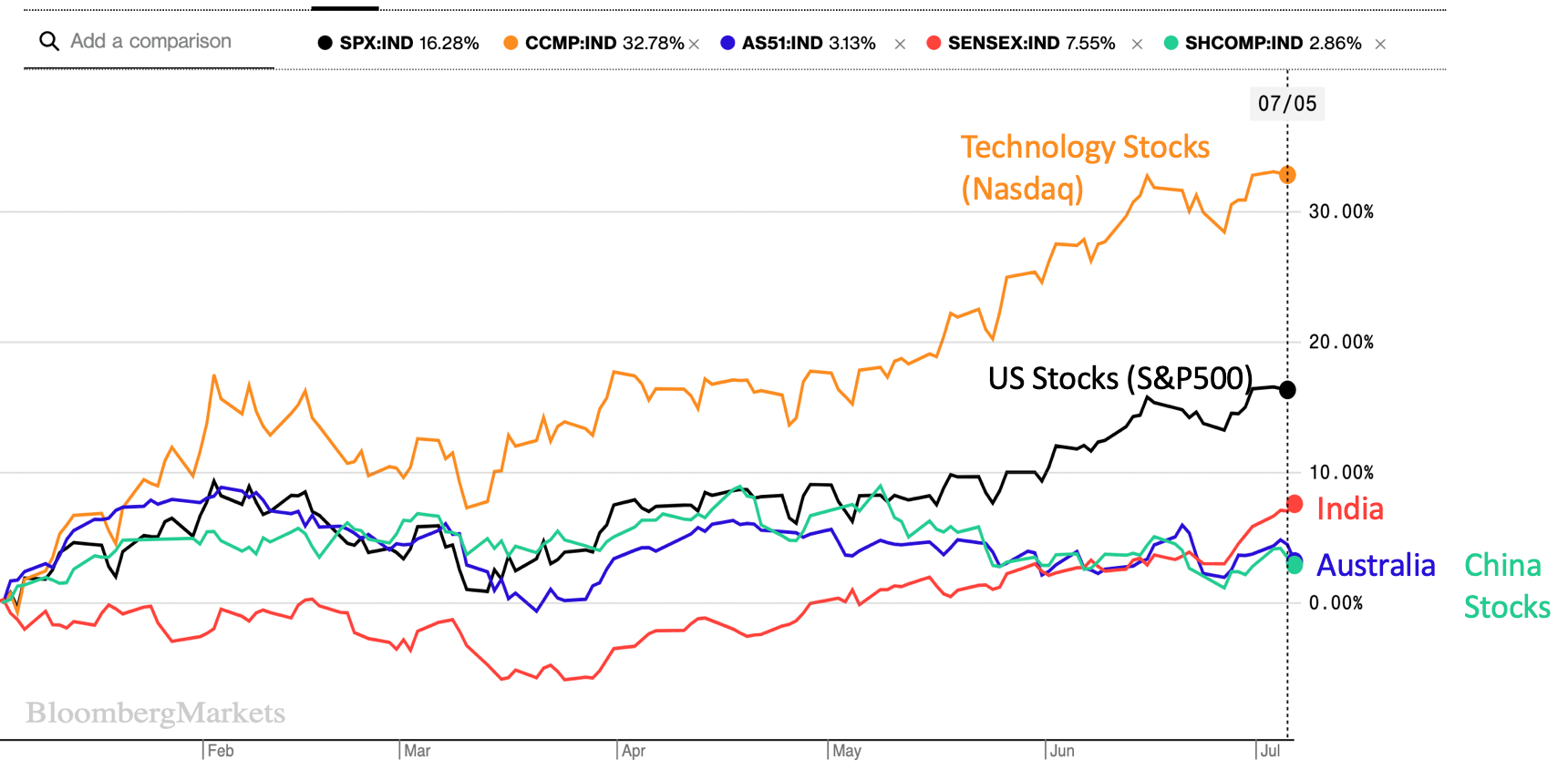

As we close out financial year ’23, we’ve seen technology stocks rally over 30% YTD, broad US stocks index up 16%, while Australian shares by comparison have delivered an unimpressive 6% (ASX 200). Gold ETF’s, which most of our clients have exposure to, have delivered 6.7% since January, and +10% over the past 12 months. Not bad!

Given such strong returns in equities and growth assets for the calendar year to date, we feel it is time to reconsider some positions in your portfolios and take profits where possible and start preparing your portfolios for what looks to be shaping up as a slower economic period ahead.

Australia’s economy is shaping up to slow in the months ahead as record interest rate increases of the past year finally reach a choke point for the consumer & corporate spending. What this means is that corporate earnings and share prices will likely respond by flirting with lows not seen in a while. The next six months pose an elevated risk of earnings and dividend cuts, which would likely introduce volatility in markets. I think the 30 June full year financial accounts of most companies will, by-and-large, come in ok as there was enough momentum in the economy closer to 30 June to get most companies over the line without negative surprises. However, it’s the months ahead that will be very interesting and 31 December financial accounts will be where the surprises amongst the large cap businesses will start to emerge. But, let me add that the market may start to bake in the potential for negative surprises ahead of time. Quite simply, the gravity of increases in the cost of capital (i.e. interest rates) over the past year should not be underestimated in its impact on the reset to spending and a shift towards a conservative investing mindset.

The simple math is that equities need to earn circa +10% p.a. investment return (i.e. risk free rate of 4%-5% plus 6% risk premium) and credit investments need to earn a real return (i.e. ahead of inflation) on income paid. If equities’ earnings are not delivering that level of return, then the share prices will reduce enough to be commensurate with that level of return. And in the case of Fixed Income, unless you are reinvesting that income fully, then in real terms your principal invested in credit investments is going backwards as the principal you invest in today’s nominal dollars will be paid back in future in a depreciated currency due to the impact of inflation. You can’t completely hedge against rapidly rising inflation, that much is understood, however, you should try and not be enticed by credit funds offering very low running yields. My sense is that inflation will stabilise in the 4-6% range for a while and so your fixed income should be delivering somewhere within that range.

Inflation is currently proving to be sticky, something we’ve been pointing out for a while (refer to previous updates). The wages momentum continues, insurance, rents, energy bills also continue to rise as of 1 July. And the prolific spending of the governments (federal & states) also continues, thus keeping inflation sticky. I will for now leave the impact on inflation from tremendous levels of investments going into energy transition and reshoring away from China for another time, all these projects require resources and manpower.

For these reasons and in combination with RBA’s chequered record of forecasting, we remain unwilling to align our hard-earned funds to RBA's forecast of 2-3% inflation anytime soon. The RBA remains firmly of the belief that it can engineer inflation down to 2-3% by raising rates unrestrained. This is despite calls by some international economists such as the IMF suggesting that central banks may need to, in so many words, become pragmatic and raise the target rate of inflation from 2-3% to a range more in line with the current realities of supply side pressures. Remember, the inflation target of 2-3% is an entirely arbitrary number with no science behind it. The real goal of central banks is to bring stability in prices, so, if prices are rising stably at 4%-6% p.a. and importantly have come off from their peak rates of 8-10% then that is a good outcome. Allow other fiscal factors to catch up such as investment in innovation and supply side constraints which, in due course, will lift productivity and reduce inflation rate down to 2-3% long term range. That would be our advice to the central banks.

Otherwise, the alternative is for RBA to remain dogmatically committed to 2-3% inflation target, as is the case for now, and drive the economy off the cliff. It is currently getting very close to that edge.

Consequently, and to err on the side of caution, we are bracing for volatility ahead as corporate earnings and dividends come under pressure.

Over the coming weeks and months, we plan to seize the market’s ambivalence as an opportunity to readjust portfolios. Specifically, dial back on growth allocations and improve the quality of exposures within each asset class. As we have noted to many of you in recent meetings, “you don’t want to have your foot on the accelerator heading into a slowing economy”!

Dial Back Growth

Dialling back growth is warranted given this may be a protracted slowdown into 2024. Most investment portfolios will have growth allocation divided amongst Australian Equities, International Equities, Property & Infrastructure, and private assets. Our preference is to be overweight international equities relative to Australian equities – China’s economy, our main trading partner, is currently a let-down and the domestic picture from rising rates I have already painted above.

We are taking profits where available particularly around gold as rising interest rates should stabilise inflation, and gold is a hedge for depreciating currency during periods of runaway inflation. This is not the case anymore. We will continue to hold positions in gold for the loger term but pulling back over-exposures to balance the benign short-term outlook.

Other places where we may look to trim will be in private and infrastructure assets. These assets tend to carry higher levels of debt on their balance sheet and while most exposures have debt fixed at low interest rates out to 2025, it is nevertheless a risk to earnings and distributions when their fixed rates mature into a higher rate. While these funds have treated your portfolio’s well, we feel the time to reconsider some of these positions given our outlook for sticky inflation and higher rates for longer is nearing.

Dial Up Income

Over the short term, we will seek to use the proceeds from profits and realignment to fund overweight positions in higher quality defensive (Fixed Interest) exposures. Keep lower quality credit i.e. hybrids & high yield around 8-10% of portfolio balance and the rest of the investment in the defensives should be higher ranking debt and term deposits (there is a term deposit equivalent ETF we use referred to as Betashares AAA etf). We consider Term Deposits as income products and not cash. They are a liability of the bank. Government bonds by and large still don’t work for us as most managers have very low running yields.

By making these adjustments we are seeking to reduce the impact of the possible volatility ahead, please note you can’t completely eliminate it as that’s what investing is all about. In slower economic periods we seek to improve the quality of exposures (large cap stocks), reduce exposure to stocks with leveraged balance sheets, improve diversification by sector and geography, with greater tilt to income generated from investment grade credit. Having said all this, Max and I would look to start adding back to growth when the central banks start cutting rates, all other things being equal.

Our key message is always to be patient, hold quality and invest with intent.