Insights & Commentary

Market Update

2023 has seen the aussie stock market up +6%, the US market up by +8.5% and US technology stocks soaring by +17%. Glad to see these beginning to reflect across our portfolios.

Australian shares are presently generating attractive gross income of 6% per annum, while fixed-interest investments are yielding over 3.5% per annum. As consumers and businesses adjust to higher interest rates, stocks are trading under fair value, thus presenting an opportunity for investors to allocate their built-up cash into the market in the coming months.

In the near term, economic conditions will be sluggish as consumption is expected to slow as the Reserve Bank of Australia (RBA) engineers a slowdown to tackle inflation. Naturally, business activity is also slowing in an overall sluggish economic environment, with overall profitability expected to remain flat in 2023 & 2024. Consequently, inflation is decreasing from its peak levels, it may still settle at moderately higher levels than what we have seen over the past decade.

Global share markets have continued to enjoy robust investment returns, as illustrated below.

Exciting Growth Ahead

Beyond the sluggish growth of the next two years, we expect economic activity to rebound due to four key factors:

- The global energy system is undergoing a once-in-a-century transition from fossil fuels to renewable energy, with trillions of dollars expected to be invested in this process.

- The intensifying competition between the US and China is expected to result in high levels of investments in domestic and friendly economies.

- The rapid pace of technology innovation, particularly in Artificial Intelligence (AI) and computing power, is reminiscent of the growth experienced in the 1990s, and we anticipate new industries and increased productivity.

- Finally, the role of governments is expanding, particularly after rewriting the social contract by bailing out the economy in the Financial Crisis of 2008 and successfully snap-freezing the economy during the COVID-19 pandemic. As China/US competition ushers in an era of defence build-up, we can expect emboldened governments and increased expenditure (i.e., fiscal deficits) facilitated by freely minted currency and occasional tax increases, in the name of levelling the playing field between the haves and have-nots.

Simple Investment Philosophy

We continue to advocate for remaining invested in good businesses (stocks) that solve real-world problems and appeal to needs over wants and have pricing power. We will invest in companies that deliver to the ‘wants’ if the price is right.

We like companies who focus on long term growth and operate in friendly countries. We like businesses that don’t borrow too much and have strong, durable cash flows. We like Management teams that have the discipline to use their net cash flows wisely, by paying healthy dividends and reinvesting for long-term growth in their businesses.

We do not accept the idea that government bonds are risk free, and we are not inclined to invest in them if they offer returns that are well below the inflation rate. We exercise caution when lending money to governments that have no intention of balancing their budgets and continue to accumulate debt. We apply the same level of prudence when dealing with unprofitable companies.

We like gold as a hedge against inflation over the long term as the value of fiat currencies will continue to come under long-term downward pressure from structural budget deficits and money printing. We like real assets and property that have utility, well located to capture occupancy, and rental income that grows in-line with inflation.

Finally, there will always be reasons to hold a negative perspective and reasons to sell. But over time, human endeavour always conquers whatever the issues are that seem so overwhelming at the time. Stay invested, stay diversified and try to be sceptical -not cynical!

Economic conditions

Inflation continues to be the most significant topic occupying the minds of anyone who has a dollar to spend or invest, and borrow.

Inflation is easing…

The good news is that inflation looks to have peaked for now. Inflation has been decisively coming down in the US over the past year and in Australia it is just beginning to peak and should start stepping down in the months ahead.

The current RBA official interest rate is 4.35% and by September 2024 the market expects it to reduce to 4.15%.

Figure 1: Australian inflation slowed to 6.8% in February 2023 after peaking in Dec 2022 at 8.4% Source: Australian Bureau of Statistics

Source: Australian Bureau of Statistics

The issue behind inflation in simple terms is that there has been too much demand for goods and services in the economy and not enough supply of labour and materials. The demand is coming from consumers, the government, businesses, and people of the world who buy our commodities and services (i.e. net exports). All of these actors are drawing on the limited supply of materials and labour in our economy. All actors got plenty of fiat money to throw around funded from previously cheap borrowings + significant net wealth gains over the past decade and in the case of governments, well, they just print the stuff.

…and households are resilient to higher cost of living

The surprising resilience in the spending power of households in the current economy stems from having built-up solid net worth over the past years. This provides households with more options and flexibility to navigate economic uncertainty and higher interest rates.

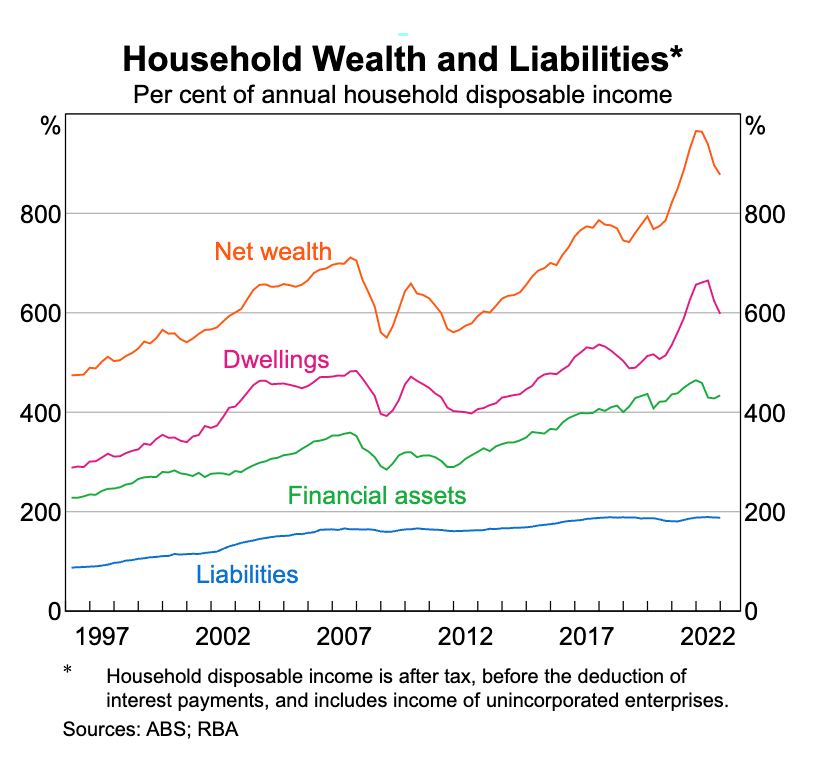

Figure 2 below shows households’ net wealth has grown much faster than their liabilities over the past decade. This wealth is in real estate which has grown in value. The wealth is also in financial assets that generated stellar returns over the decade e.g. Australian shares (+80%, ASX200), US shares (+215%, S&P500) and we are not including the dividend returns here either. Global bonds would have delivered approx. +26% over the past ten years (we have used PIMCO Global Bond fund here as a proxy) and so on.

Figure 2: Australian households have accumulated significant net wealth

Higher interest rates to persist because higher inflation will persist

For now the RBA remains dogmatically committed to bringing inflation down to the target of 2-3% p.a. by reducing consumption of households & businesses. The only tool it has on hand is to raise interest rates & continue threatening the borrowers with further interest rate increases ahead. Over the past year, the official interest rate has risen from 0.1% to 3.6% currently.

The RBA is currently on pause for further rate increases because it can see inflation is starting to come down. However, it is going to be a tall task to bring inflation down to 2-3% and importantly keep it there for reasons we explain below! So, there is a possibility that interest rates could go higher over the next two years.

Unemployment in Australia is expected to remain very low between 3.5-4% for the next two years. Provided everyone that wants a job, has a job combined with net wealth supported by largely intact asset prices it is thus going to be a tall task for the RBA to hold down consumption and bring inflation down to 2-3%.

The past fifty years of economic history suggest that the RBA in the past had to raise interest rates much, much, higher than the rate of inflation (and hold rates there for a long time) to bring inflation down. This helps to explain that despite the sharp increases in interest rates to 3.6%, we still have a situation of inflation sitting much higher at close to 7% in Australia. So, expect higher, not lower, interest rates as a base case!

Additionally, longer-term changes are currently underway in the global economy pointing to a moderately high inflationary environment in the years ahead. The pressure on the available supply of resources is set to continue (particularly the metal commodities, energy, and labour) due to the demand from the following factors:

- Trillions of dollars to be invested in the transition to renewable energy infrastructure (which will take years) – we understand not everyone subscribes to the climate change theory, however, there is now clear consensus amongst big capital and major governments for the need to stop climate change. The discussion now is on the speed of change and it is accelerating.

- Infrastructure investment in re-shoring global supply chains - The strategic competition between China/Russia on one side and US/Allies on the other will just continue to intensify. Each side will require rebuilding previously outsourced industry and upgrading domestic transport infrastructure of all manner within the orbit of each side’s influence.

- Ageing population – advanced economies have for years been suffering from low birth rates which are not sufficient for the replacement and growth of their population. They have had to rely on immigration for population growth. Aging demographics will require more health spending and chronic disease burden will take more people out of the full-time labour pool and affect labour productivity. The younger population saddled with the debt of the previous generations and the burden of the aging population are unlikely to settle for wage increases of 2% p.a. So, expect the services sector to continue feeling the pressure of higher wages. The resurgent labour unions are already out on the streets!

Finally, we expect inflation to persist at moderately high levels in the years ahead as the recent past of ridiculously low interest rates is now thankfully behind us. Savers can look forward to higher rates with an increasing number of income options ranging from higher yielding bank term deposits, term annuities, and attractive income returns on fixed interest securities.