Insights & Commentary

The year that was….

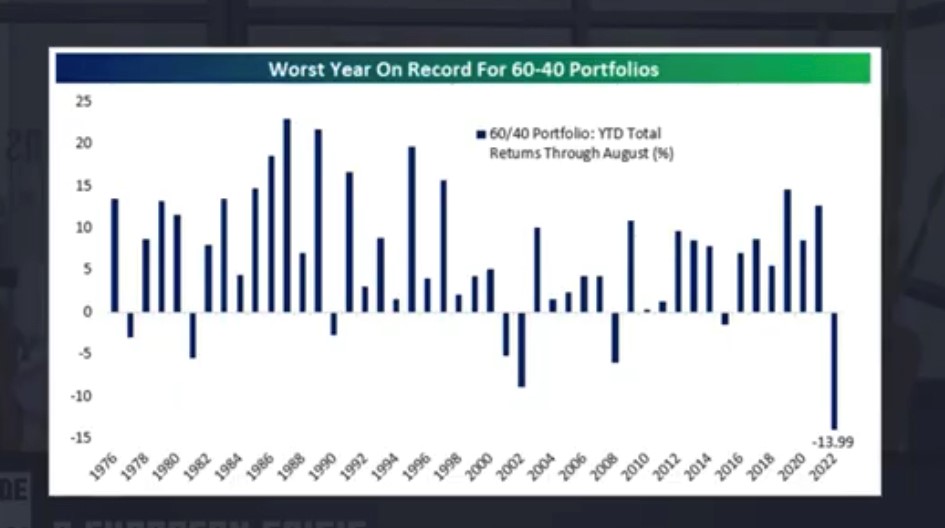

This chart sets the scene providing unprecedented evidence of how tough this year was for balanced portfolios.

Thankfully our portfolios outperformed due mainly to our exposure to gold and floating rate “fixed” interest (as opposed to fixed rate govt bonds). Other than a couple of portfolios who are opposed to oil and gas investments, this sector has also supported portfolios well.

What does 2023 hold?

Interest rates:

Australia has at least two more rises (Feb is the next RBA meeting). We don’t expect our rates to reach the heights of the US because whilst we over stimulated during covid, it wasn’t nearly as reckless as the US.

US: We anticipate only 0.5% more to go before a pause. This is despite strong jawboning by Federal Reserve Chairman Jerome Powell to the contrary. He wants to scare the economy into contracting rather than wounding it. I wouldn’t be surprised if we see the Fed funds rate begin to fall towards the end of 2023.

Inflation:

Aust is lagging the US in the cycle and we don’t have the energy shock of Europe. I still think we have a fighting chance of avoiding recession. Income from resource companies should once again save us.

US: Goods inflation is close to deflation. This has been an incredibly quick turnaround (supply chains opening up have helped). But core inflation, which is largely services (wages) is sticky. I can’t see this dropping whilst unemployment is at all time lows. I expect the falling cost of goods will result in continued fairly rapid falls in inflation until mid year and then CPI should settle around 3-4%. Considerably higher than the 2% the Fed claims to be targeting. The 3-4% level will be made up almost entirely from wage growth. It would take a deep recession to increase unemployment to the 6-7% level that would be needed to wipe out wages growth. So whilst the Fed is talking tough, I just don’t think they’ll destroy the economy and instead I expect they’ll settle for 3-4% and remind us that the targeted 2-3% is a “long term average”.

Opportunities:

US small companies (circa $5b!) are trading at historic discounts to large companies. PE ratios are 12x Vs 22x for large companies.

Emerging markets: Countries such as China, Indonesia, Brazil etc are trading at historic discounts relative to the US. They’re about 40% cheaper despite having higher GDP growth, younger demographics and less consumer debt.

Interestingly the US now makes up 61% of the world’s sharemarkets market capitalisation. China is just 3.5%! Apple and Microsoft are bigger than China!

Gold: We expect gold to continue to be the safe haven we’ve come to expect. Governments will continue to devalue their currencies by printing money and safe havens like gold should hold strong due purely to their limited supply. It’s an asset a government cannot undermine. It was hoped Bitcoin would do exactly that, again based on limited supply, but the dramas surrounding that sector should result in gold again being a favoured store of wealth. In 2022 governments purchased 400 tonnes- the largest on record. The shiny relic isn’t dead yet!

Other markets look about fair value. I had expected they’d might fall further and then rally strongly next year. But without the fall (ASX is only down about 5%), there’s not the impetus for a strong rally.

For those comfortable investing in fossil fuels, these companies look cheap, as institutions have been pressured into dumping them from their portfolios. Additionally shareholders have lobbied boards into returning capital rather than reinvesting (fear of growing alternate energy sources). This has resulted in massive underinvestment and now supply pressures, which is sure to keep prices buoyed even during a recession.

Risks:

Geopolitical: Russia/ Taiwan etc (almost impossible to quantify)

Federal Reserve breaking the economy: Raising rates too high, too fast, is a real risk. If there were signs of a weaker labour market, We’d say this was inevitable. But right now a mild to average US recession looks likely.

Contagion risk: This could come from anywhere. I would never have expected UK pension funds to be borrowing to invest in govt bonds. They effectively received margin calls and had to dump govt bonds at increasingly massive losses to make the payments. Then there were no buyers and the govt had to step in. Meanwhile the pound was severely impacted. I would never have guessed a boring long term pension fund would apply that level of risk to try and extract a small increased return.

Debt: During those years of 0% interest rates, someone is holding massive debt (other than Uk pension funds). There are concerns this might be found in private equity. Good old fashioned greed may have made cheap debt irresistible. However these small, high growth businesses that PE invests in, generally have no profits in their early years. So now that interest rates have risen massively, Im concerned there could be some fire sales to reduce their debt/ or even just to service the interest costs.

Overall it wasn’t a great year for us, but when we reflect on our performance compared to the market, we should all be very pleased (in a relative sense!).

We wish you a peaceful Christmas and all the best for 2023!